Malaysia

Kertang

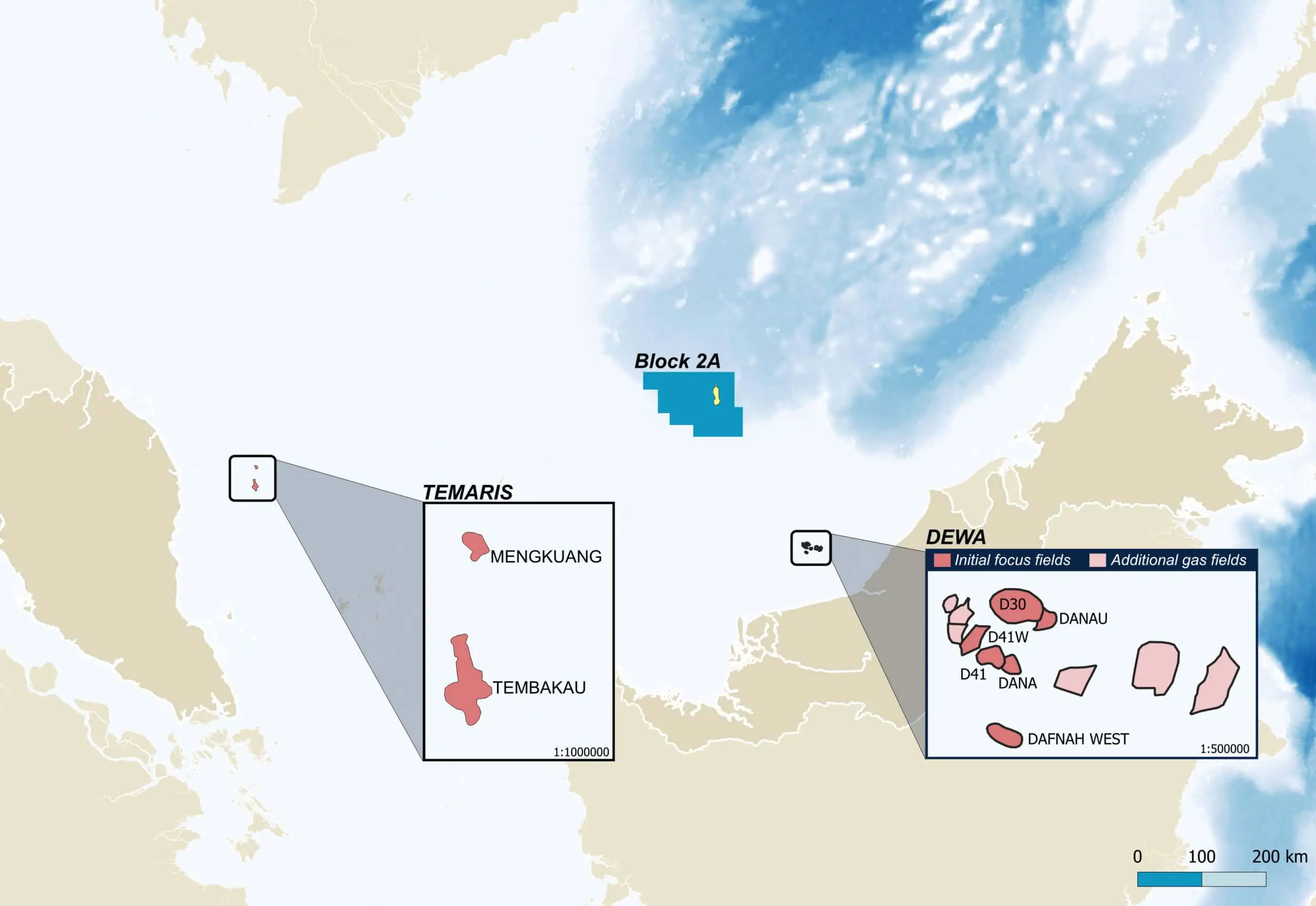

Prospect: Kertang, Block 2A

Partners: INPEX (operator 42.5%), Seascape (10%), PETRONAS 40%, PETROS (7.5%)

DEWA

Discoveries: DEWA Complex Cluster

Partners: EnQuest (operator 42%), Seascape (28%), PSEP (30%)

Temaris Cluster PSC

Discoveries: Tembakau and Mengkuang Fields

Participants(s): Seascape (100%)

Block 2A is located offshore Sarawak, eastern Malaysia in the North Luconia hydrocarbon province covering approximately 12,000 km2 in water depths between 100 -1,400 metres. Block 2A contains the world-class Kertang prospect, located across four Oligo-Miocene reservoirs, which can be summarised as follows:

- Well-defined, large, four-way dip structural high with over 220 km2 of closure;

- Covered by high-quality, wide-beam 3D seismic shot by CGG in 2015;

- Exhibits direct hydrocarbon indicators (DHIs) including an overlying gas cloud feature and amplitude brights;

- CPR undertaken by ERCE on Kertang in 2024 assigns total gross, unrisked mean prospective resources of 9.1 TCF plus 146 mmbbl of NGLs (~1.7 billion boe);

- CPR chance of success of ~20%;

- Bintulu LNG, one of the world’s largest LNG facilities, is located onshore Sarawak;

- Based on regional offset wells, third-party high-level cost estimates for a successful Kertang exploration well in excess of US$70 million (gross).

Block 2A was originally awarded to Seascape in February 2023 as part of the Malaysian Bid Round 2022 by PETRONAS Malaysia Petroleum Management (“MPM”). MPM acts on behalf of PETRONAS in the overall management of Malaysia’s petroleum resources throughout the lifecycle of upstream oil and gas assets. Seascape’s initial interest in Block 2A was 36.75% which was increased to 52.5% following the acquisition of Topaz Number One Limited in September 2023.

The Company undertook a farm out process in mid-2024 which culminated in a transaction with INPEX CORPORATION, Japan’s largest exploration and production company, where Seascape assigned operatorship and a 42.5% interest in the PSC to INPEX in return for:

- a full, uncapped carry for Seascape’s retained interest (10%) through the remaining exploration phase which includes one firm wildcat well and one contingent appraisal well (subject to a commercial discovery);

- initial cash consideration of US$10 million which was paid on completion in March 2025 together with the reimbursement of certain historic costs associated with the PSC totalling ~US$1.0 million; and

- further contingent cash consideration of US$10 million payable on a commercial discovery;

Seascape through its 10% retained interest still has a material exposure to the Kertang prospect with net unrisked mean prospective resources of ~910 bcf and ~15 mmbbl of NGL (~166 mmboe). A summary of the CPR published in June 2024 can be found on the Company’s website: https://seascape-energy.com/presentations-reports/.

In October 2025 the joint venture partners approved entry into the second exploration phase of the PSC and drilling of the giant Kertang prospect (subject to Petronas MPM formal approval). This commitment allows the joint venture to now focus on securing a suitable drilling rig and identifying the precise drilling location to test the Kertang structure.

The second exploration phase includes a firm, minimum work commitment of one wildcat exploration well and one contingent appraisal well. Seascape anticipates that the Kertang well to be part of a wider deepwater exploration drilling campaign across multiple blocks in Malaysia during 2026 and 2027 to be undertaken by the operator. Seascape will provide further details regarding the anticipated timing of drilling once available.

In October 2024, Seascape was awarded a 28% participating interest in a Small Field Asset Production Sharing Contract over the DEWA Complex Cluster off the coast of Sarawak, Malaysia. The Award was made under the Malaysia Bid Round Plus by Petroliam Nasional Berhad (PETRONAS).

DEWA is comprised of 12 gas discoveries in shallow water (40-50 metres) near to infrastructure off the coast of Sarawak and includes; D30, D30W, Danau, Daya, Daya North, D41, D41W, Dafnah West, Dana, Darma, West Acis and Spaoh. Gas was originally found in the area in 1982 but overlooked by previous partnerships which were focused on oil production.

The DEWA partnership is anticipated to focus initially on the D30, Danau, D41, D41W, Dana and Dafnah West discoveries. These fields are broadly characterised as having clastic reservoirs with large gas columns and good hydrocarbon mobilities. There is a significant dataset including 35 well penetrations, well logs, multiple DSTs and MDTs as well as extensive 3D seismic coverage across the entire PSC area.

In August 2025, Seascape announced the results of a Competent Person’s Report undertaken by Sproule-ERCE on the Company’s resources, which included these six fields within the DEWA Cluster prioritised for the initial phases of development. Sproule- ERCE have attributed net 2C Contingent Resources of 94 bcf and 1.8mmboe of liquids (in total 18 mmboe) with additional upside in and around the DEWA Complex for future pursuit. This includes an additional 7 bcf of unrisked net mean Prospective Resources (25 bcf gross) in an undrilled fault block on Dafnah West.

Given the shallow water depths and nearby infrastructure, the partnership is targeting a low-cost development plan utilising normally unmanned platform(s) with minimal processing which could support a potential production plateau of up to 100 mmscfd.

The initial low-cost work commitment (approximately $0.6 million net to Seascape) is to conduct a detailed resource assessment and deliver a Field Development and Abandonment Plan within two years. The development of these fields will be under the innovative, new Small Field Asset terms which are specifically designed to simplify and incentivise rapid development of smaller hydrocarbon accumulations in Malaysia.

In June 2025, Seascape was awarded a 100% participating interest and operatorship in the Temaris Cluster in the Malaysia Bid Round 2025. The acreage includes two gas discoveries in shallow water (~70 metres) offshore Peninsular Malaysia on the western flank of the Malay basin and covers an area of around 1,200 km2.

The main discovery, Tembakau, was originally made in 2012 and appraised in 2014 and benefits from an extensive dataset including full 3D seismic coverage, well logs, DSTs and extensive well core. Tembakau is located near to infrastructure with the closest producing gas field ~50 km away from the field.

The Tembakau field comprises Early-Mid Miocene channel sandstone reservoirs which are clearly imaged on 3D seismic and exhibit a strong amplitude response. The field has excellent reservoir properties with porosities of 20% to 35% and permeabilities of over one Darcy and contains dry gas with very low levels of impurities. The Tembakau-2 well was tested and produced from the I-10 and I-20 reservoirs, with both reservoirs flowing at gas rates of 16 mmscfd, constrained by the well test equipment used.

The smaller Mengkuang discovery is located 30 km to the northeast of Tembakau in high-quality mid-Miocene sandstones and also demonstrates strong seismic amplitude response. The field is split into several lobes and benefits from a good dataset but was not tested at the time of discovery.

Sproule-ERCE have prepared a Competent Person’s Report on the associated resources and attributed net 2C Contingent Resources of 276 bcf with exploration upside of 950 bcf (158 mmboe) mean Prospective Resources, located in amplitude-supported prospects analogous to the existing discoveries.

Similar to the Company’s DEWA Complex Cluster (Seascape, 28%) development asset, the Temaris Cluster development will fall under the Small Field Asset (“SFA”) terms which are specifically designed to simplify and incentivise rapid development of smaller hydrocarbon accumulations in Malaysia and provide enhanced field economics versus traditional PSCs.

Given the shallow water depths and nearby infrastructure, Seascape is targeting a low-cost development plan utilising a normally unmanned platform with minimal processing which could support a potential gross production plateau of up to 100 mmscfd.

The key terms of the Award are to deliver a Field Development and Abandonment Plan within 18 months along with certain specialised subsurface studies and 3D seismic reprocessing. The financial commitment under the Award is ~US$2 million and will be met through Seascape’s existing cash resources.

DEWA

Discoveries: DEWA Complex Cluster

Partners: EnQuest (operator 42%), Seascape (28%), PSEP (30%)

In October 2024, Seascape was awarded a 28% participating interest in a Small Field Asset Production Sharing Contract over the DEWA Complex Cluster off the coast of Sarawak, Malaysia. The Award was made under the Malaysia Bid Round Plus by Petroliam Nasional Berhad (PETRONAS).

DEWA is comprised of 12 gas discoveries in shallow water (40-50 metres) near to infrastructure off the coast of Sarawak and includes; D30, D30W, Danau, Daya, Daya North, D41, D41W, Dafnah West, Dana, Darma, West Acis and Spaoh. Gas was originally found in the area in 1982 but overlooked by previous partnerships which were focused on oil production.

The DEWA partnership is anticipated to focus initially on the D30, Danau, D41, D41W, Dana and Dafnah West discoveries. These fields are broadly characterised as having clastic reservoirs with large gas columns and good hydrocarbon mobilities. There is a significant dataset including 35 well penetrations, well logs, multiple DSTs and MDTs as well as extensive 3D seismic coverage across the entire PSC area.

In August 2025, Seascape announced the results of a Competent Person’s Report undertaken by Sproule-ERCE on the Company’s resources, which included these six fields within the DEWA Cluster prioritised for the initial phases of development. Sproule- ERCE have attributed net 2C Contingent Resources of 94 bcf and 1.8mmboe of liquids (in total 18 mmboe) with additional upside in and around the DEWA Complex for future pursuit. This includes an additional 7 bcf of unrisked net mean Prospective Resources (25 bcf gross) in an undrilled fault block on Dafnah West.

Given the shallow water depths and nearby infrastructure, the partnership is targeting a low-cost development plan utilising normally unmanned platform(s) with minimal processing which could support a potential production plateau of up to 100 mmscfd.

The initial low-cost work commitment (approximately $0.6 million net to Seascape) is to conduct a detailed resource assessment and deliver a Field Development and Abandonment Plan within two years. The development of these fields will be under the innovative, new Small Field Asset terms which are specifically designed to simplify and incentivise rapid development of smaller hydrocarbon accumulations in Malaysia.

Temaris Cluster PSC

Discoveries: Tembakau and Mengkuang Fields

Participants(s): Seascape (100%)

In June 2025, Seascape was awarded a 100% participating interest and operatorship in the Temaris Cluster in the Malaysia Bid Round 2025. The acreage includes two gas discoveries in shallow water (~70 metres) offshore Peninsular Malaysia on the western flank of the Malay basin and covers an area of around 1,200 km2.

The main discovery, Tembakau, was originally made in 2012 and appraised in 2014 and benefits from an extensive dataset including full 3D seismic coverage, well logs, DSTs and extensive well core. Tembakau is located near to infrastructure with the closest producing gas field ~50 km away from the field.

The Tembakau field comprises Early-Mid Miocene channel sandstone reservoirs which are clearly imaged on 3D seismic and exhibit a strong amplitude response. The field has excellent reservoir properties with porosities of 20% to 35% and permeabilities of over one Darcy and contains dry gas with very low levels of impurities. The Tembakau-2 well was tested and produced from the I-10 and I-20 reservoirs, with both reservoirs flowing at gas rates of 16 mmscfd, constrained by the well test equipment used.

The smaller Mengkuang discovery is located 30 km to the northeast of Tembakau in high-quality mid-Miocene sandstones and also demonstrates strong seismic amplitude response. The field is split into several lobes and benefits from a good dataset but was not tested at the time of discovery.

Sproule-ERCE have prepared a Competent Person’s Report on the associated resources and attributed net 2C Contingent Resources of 276 bcf with exploration upside of 950 bcf (158 mmboe) mean Prospective Resources, located in amplitude-supported prospects analogous to the existing discoveries.

Similar to the Company’s DEWA Complex Cluster (Seascape, 28%) development asset, the Temaris Cluster development will fall under the Small Field Asset (“SFA”) terms which are specifically designed to simplify and incentivise rapid development of smaller hydrocarbon accumulations in Malaysia and provide enhanced field economics versus traditional PSCs.

Given the shallow water depths and nearby infrastructure, Seascape is targeting a low-cost development plan utilising a normally unmanned platform with minimal processing which could support a potential gross production plateau of up to 100 mmscfd.

The key terms of the Award are to deliver a Field Development and Abandonment Plan within 18 months along with certain specialised subsurface studies and 3D seismic reprocessing. The financial commitment under the Award is ~US$2 million and will be met through Seascape’s existing cash resources.